By regulation, you may have only sixty days to accomplish this transaction and then the cash turn into taxable on withdrawal. Also, the regulation lets only just one tax-totally free rollover of IRA money per year.

Especially, “the trustee or custodian need to be a lender, federally insured credit union, conserving and loan association, or an entity accepted from the IRS to act as a trustee or custodian.”

Prior to making any definitive selections about your Gold IRA, review its conditions and terms carefully. Some gold IRA companies may perhaps impose certain liquidating gold prerequisites or expenses when providing precious metals holdings from this account.

When An important correction happens, investors have the inverse opportunity, to capture principal and take advantage of their precious metal investments and reacquire stocks, bonds, and currencies at deal prices. And all of this happens on the tax-totally free basis, right until it is necessary for retirement, when buyers are in the lessen income tax bracket.

You could find out all the things important for effective gold IRA investments, from the account rollover process to eligible precious metals and storage solutions.

When opening one it’s essential that you understand these rules as well as collaborate with an established custodian who'll guarantee all investments keep on being compliant and safe.

Finding a gold IRA firm that could handle all the things in your case in A fast manner is critical. To figure out with regards to the speed and efficiency of a gold IRA, look to find out if they have got a network of services in position.

You almost certainly found that a lot of the companies shown over concentrate on IRA investing. Also referred to as somebody retirement account (IRA), these investment automobiles have been released while in the 1970s to let Us he said citizens commit for his or her retirement with a tax-advantaged foundation.

When choosing a gold bar for an IRA account it’s necessary that they come from accredited producers regarded by businesses such as the London Bullion Industry Association or very similar bodies for being recognized as IRA gold.

Limited Liquidity: Marketing physical gold or precious metals can occasionally consider for a longer time than providing paper assets, which could be a priority if you want quick usage of money.

You should in no way have all of your current investments in one location, even whether it is a comparatively “safe” investment System. A gold IRA is a great way to diversify as it is so different from other varieties of retirement accounts.

By storing the gold in Delaware, consumers can gain from tax breaks provided while in the point out, such as no individual assets tax or professional Internet value tax.

On line purposes and information need to be available. It is often a terrific benefit if the organization you select specializes in Gold IRA’s in lieu of just presents (dabbles in) the provider.

Only mentioned, no person may act as their particular custodian for an Individual Retirement Account or Gold IRA. In line with IRS rules, More Bonuses only competent trustees or custodians are authorized to carry Home Page these types of assets – this guarantees compliance with policies and laws whilst safeguarding both equally account holder passions and also government ones. Study gold IRA companies and obtain the appropriate healthy for your personal precious metals.

Jaleel White Then & Now!

Jaleel White Then & Now! Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Alisan Porter Then & Now!

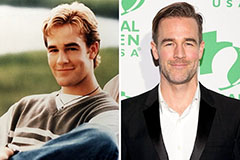

Alisan Porter Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now!